Investors

Our consistent financial performances have enabled us to retain our market leadership in a competitive environment. With a growing global presence, prudent capital allocation and a strategic roadmap for future growth, we are poised to capitalise on emerging opportunities and deliver sustainable returns to our investors.

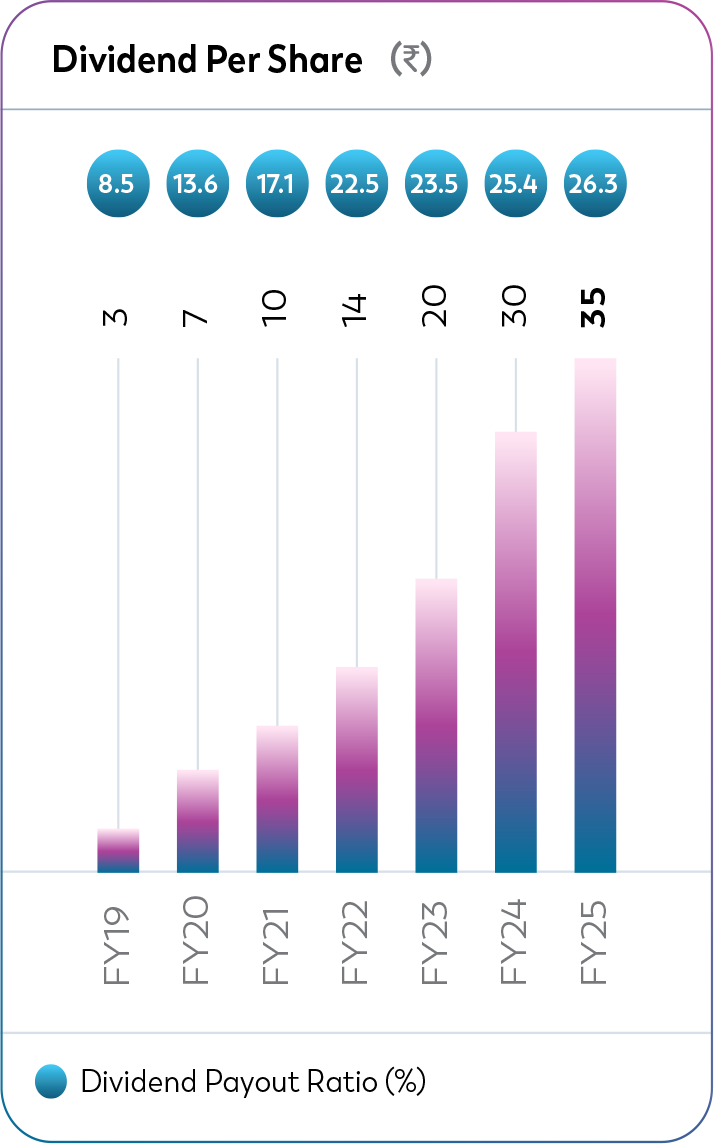

35

Domestic and global conferences attended in FY 2024-25

5

International investor geographies covered via NDRs in FY 2024-25

26.30%

Dividend payout Ratio

5

Increase in analyst coverage, taking total coverage to 42 brokerage houses

SDGs Impacted

Linkage of Capitals

FFinancial Capital

`99,068Mn

Pool of funds that we can utilise to scale operations

MManufacturing Capital

`9,583 Mn

Incurred capex

IIntellectual Capital

Invested in R&D to develop and produce future-ready products and improve our services

HHuman Capital

`7,367 Mn

Employee benefit expenses increased by 21% YoY

SSocial and Relationship Capital

`356 Mn

Funds utilised towards CSR

NNatural Capital

Utilised funds for various initiatives such as energy efficiency, waste management, and water management, among others among others

Material Topics

4R&D, Innovation & Product Stewardship

11Economic Growth & Market Opportunities

12Product Safety & Quality

13Data Privacy & Cybersecurity

14Corporate Governance, Ethics and Integrity

We believe in providing sustainable returns to our shareholders by pursuing consistent growth and practicing responsible financial management

Our Approach to Investor Engagement

Our investor relations strategy is built on transparent, consistent and meaningful communication. We engage through multiple channels, actively seek investor feedback and respond with clarity and accountability. By upholding strong corporate governance and demonstrating a sustained commitment to sustainability, we reinforce investor confidence. At the core of our approach is a long-term focus on building relationships founded on mutual respect and aligned interests, essential drivers of sustainable growth and long-term shareholder value.

How We Engage with Them

- Formal results presentations and earnings calls every quarter, ensuring timely and transparent communication of our financial performance

- Annual General Meeting

- Regular engagement with the investor community through direct meetings or participation in investor conferences

- Non-deal Roadshows

Key Topics Discussed

- Long-term growth strategy

- Financial performance during the year

- Capital allocation

- Corporate governance and stakeholder alignment

Dividend Distribution

While recommending dividends to shareholders, our Board of Directors evaluates the following internal and external factors:

Internal

- Profits earned during the financial year

- Retained earnings

- Earnings outlook for the next three to five years

- Expected future capital/ liquidity requirements

- Any other relevant factors and material events

External

- Macroeconomic environment

- Regulatory changes

- Technological changes

Polycab categorised as a large-cap stock in FY 2024-25 by AMFI

Increasing Return on Investment

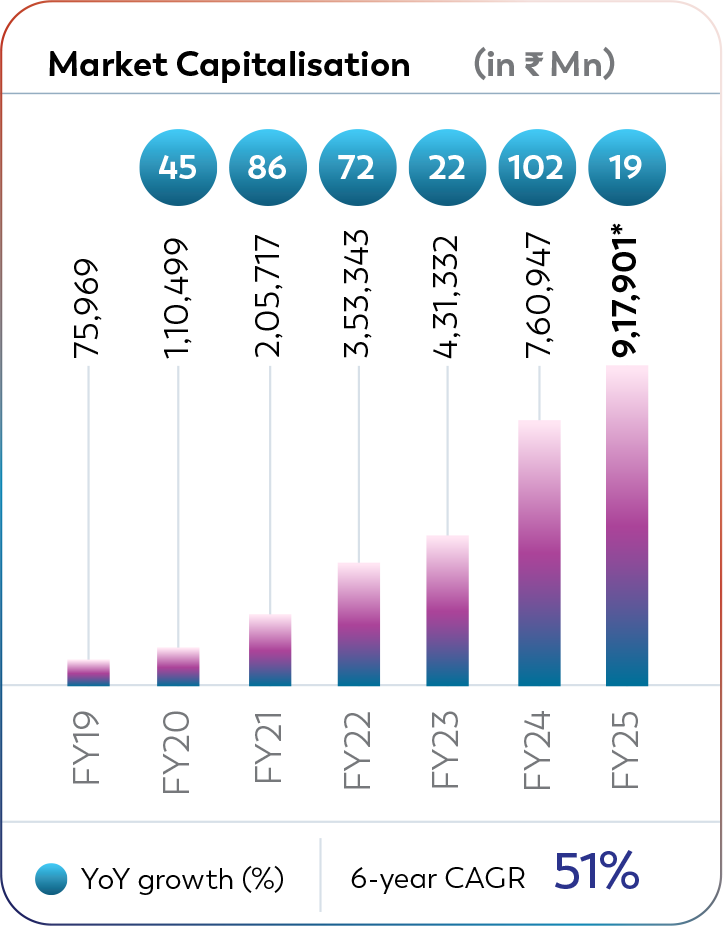

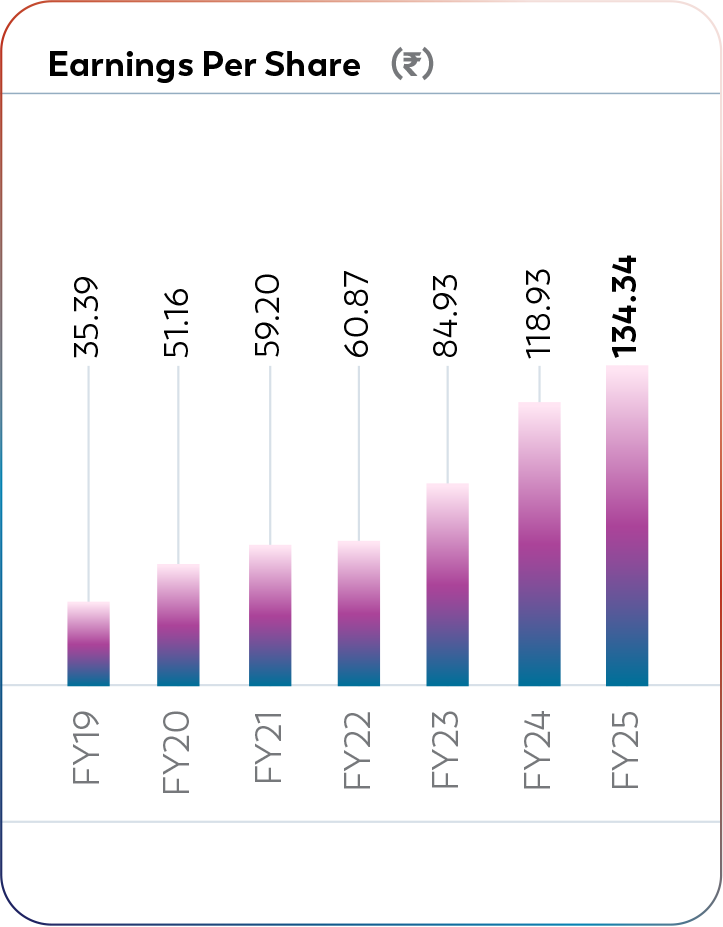

Since our listing, we have delivered exceptional growth, achieving a 51% CAGR in market capitalisation, rising from `76 billion on 16 April 2019 to `918 billion as of 19 May 2025. This strong trajectory reflects the continued confidence and trust our shareholders and investors place in us.

Over the same period, we have steadily increased our dividend payout ratio, reaching 26.3%, underscoring our commitment to sharing the value we create. Our approach is anchored in sustainable returns, consistent growth and responsible financial management principles that drive long-term value for our shareholders.

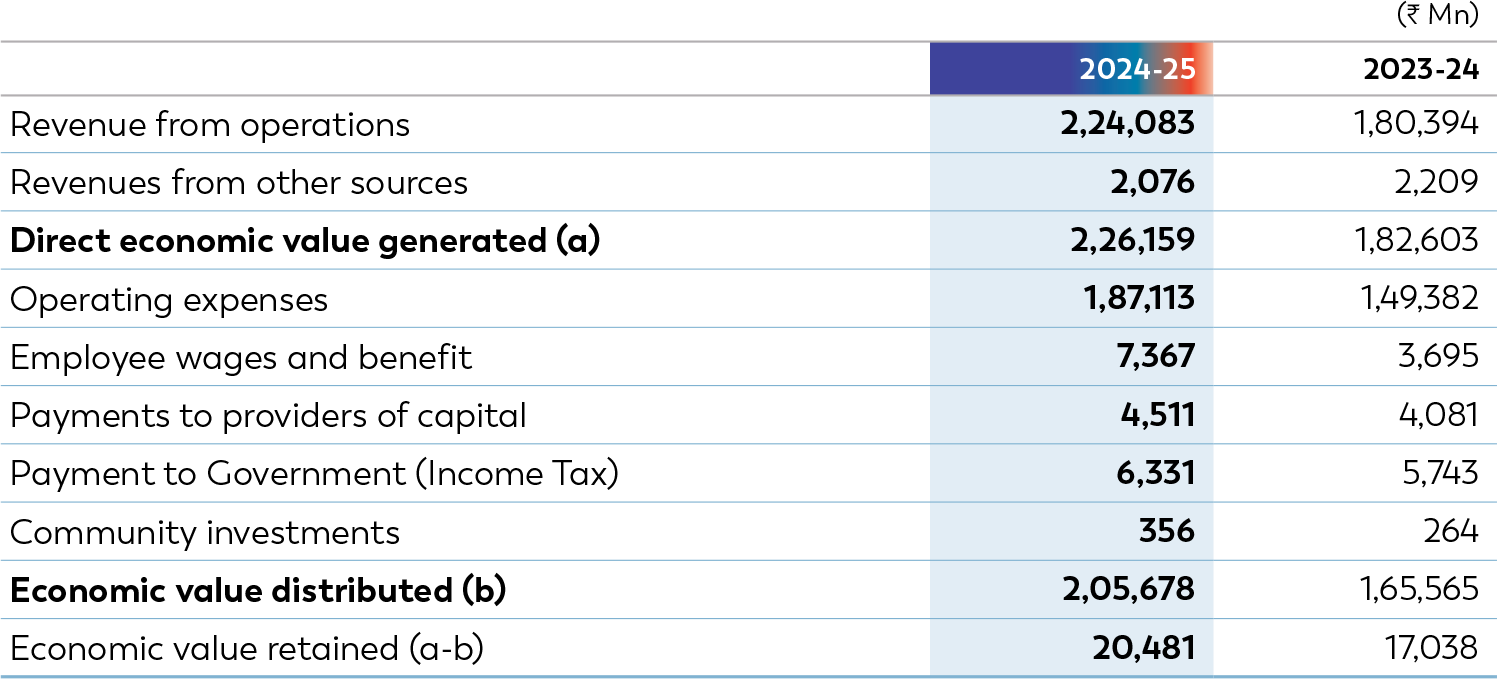

Economic Value Creation

Financial Performance

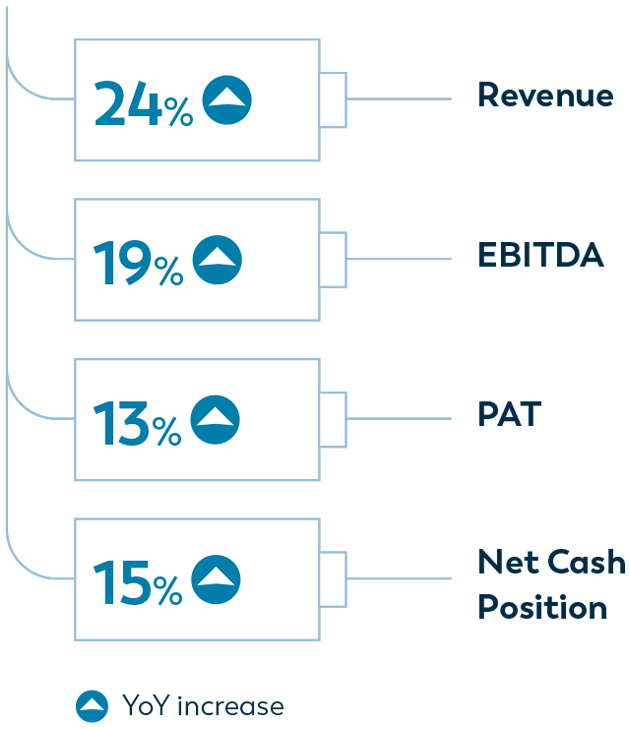

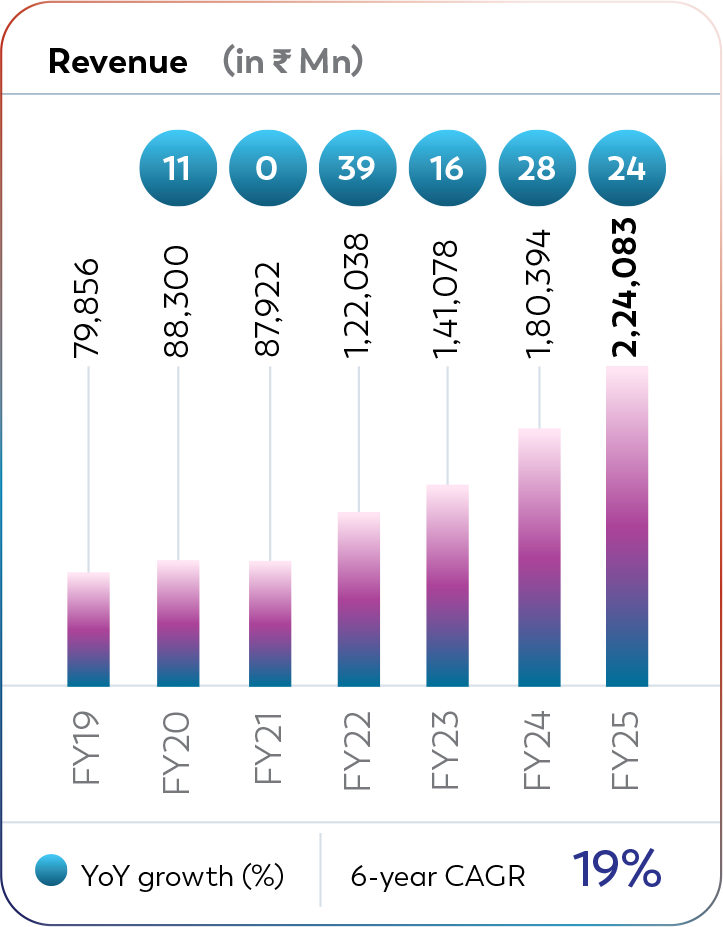

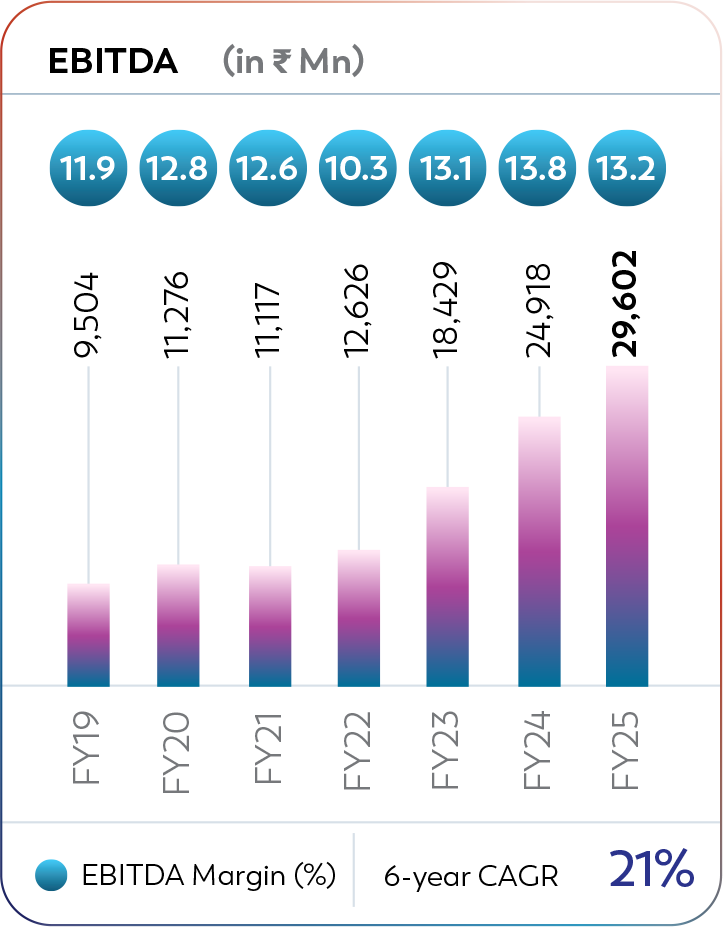

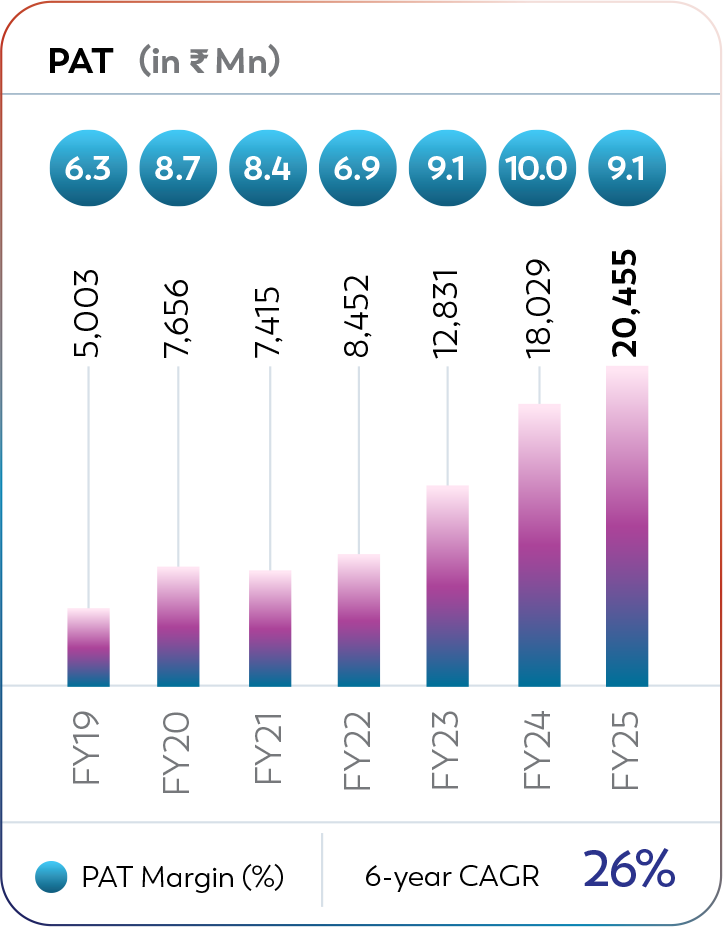

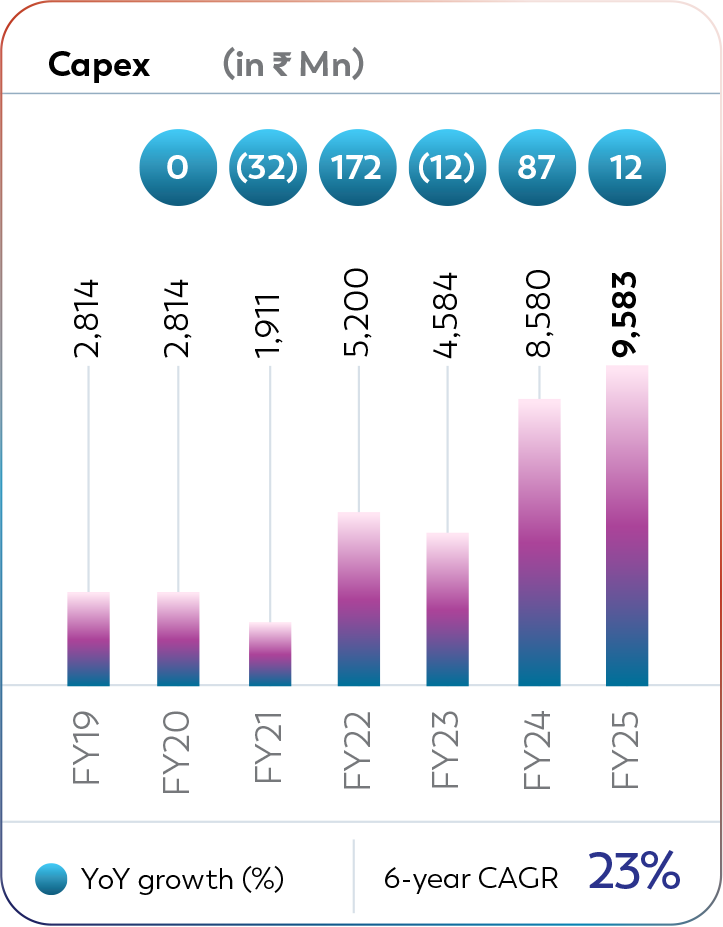

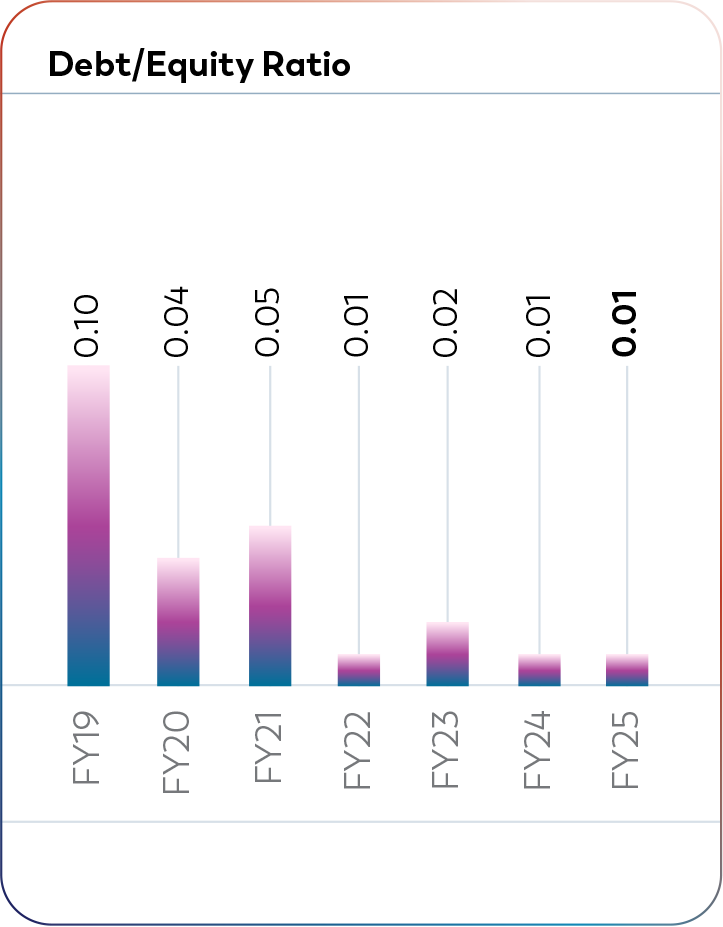

In FY 2024-25, Polycab delivered yet another year of strong financial performance. The Company reported revenue of `2,24,083 million during FY 2024-25, achieving 24% YoY growth. EBITDA grew by 19% YoY to `29,602 million. The Return on Capital Employed (RoCE) stood at 28.70%, highlighting the Company’s operational efficiency and prudent capital allocation strategy. Additionally, the Company continued to make strategic investments with a capital expenditure of `9,583 million, reinforcing its commitment to future growth.

Capital Allocation Roadmap

We have defined four core avenues for utilising our cash:

Capex

Capital expenditure continues to be a strategic priority. During the year, we invested `9,583 million in capex, compared to `8,580 million in the same period last year. These investments were primarily directed toward capacity expansion, backward integration, automation and technological advancements aimed at improving operational efficiency and reinforcing our manufacturing capabilities.

Looking ahead, in-line with our guidance under Project Spring, we plan to invest `60–80 billion over the next five years to support our long-term growth objectives and build a stronger, future-ready business.

Dividends

We have consistently increased dividend payout since our listing, increasing dividends from `3 per share in FY 2018-19 to `35 per share in FY 2024-25. This reflects our commitment to delivering value to our shareholders while supporting our long-term growth journey.

Mergers and Acquisitions

We are actively pursuing inorganic growth opportunities to enhance our capabilities and solidify our position within the Wires & Cables and FMEG sectors.

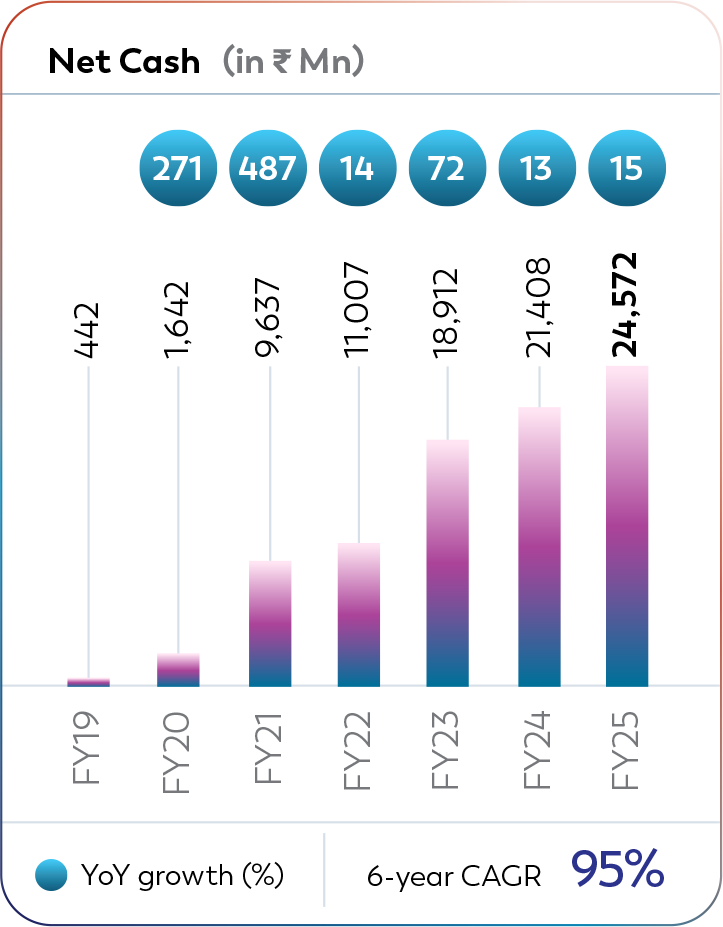

Cash Reserves

A portion of our cash will be retained as a buffer on our balance sheet to provide flexibility and support in navigating both favourable and challenging business environments.

Consistent Growth Trajectory

*As on 19 May 2025