PRING

PRINGTowards New Growth Horizons

At Polycab, we had set an ambitious target of reaching sales of `200 billion by FY 2025-26 under Project LEAP. In FY 2024-25, we have surpassed this figure and achieved sales of more than `220 billion, well ahead of the committed timeframe. We are now embarking on the next leg of our journey with Project Spring.

Discover More

Discover More

- Solidifying Market Leadership in B2B

- Propelling B2C Expansion

- Ramp-up International Business

- Innovation and Automation-Led Holistic Development

- Nurture talent and capabilities

- Growing ESG integration

W&C Business

~1.5x

of Market Growth in Core segments

11-13%

EBITDA Margin

>10%

Contribution from Exports to Company’s Top-Line

FMEG Business

1.5x-2x

of Market Growth

8-10%

EBITDA Margin

Cash Flow Guidance

₹60–80 Bn

Capex

>30%

Dividend Payout Ratio

Our ESG strategy aims to inculcate positive efforts to initiate change and create lasting value for all stakeholders.

Our ESG Approach

Discover More

Discover More

1,57,554 GJ

Renewable Energy Consumption

19,220 MT

Waste Recovered (Recycling and Reuse)

31,336 MTCO2e

Emissions Avoided Due to Renewable Energy

32,45,000 Watts

RE capacities installed across various locations

0.11

LTIFR

2,35,000 +

CSR Beneficiaries since past 2 years

Zero

High-Consequence Injuries & Fatalities

36+

Flagship CSR programmes

55%

Board Independence

100%

Committees led by Independent Directors

87.8%

Sustainable Sourcing

100%

Supplier Code of Conduct alignment rate

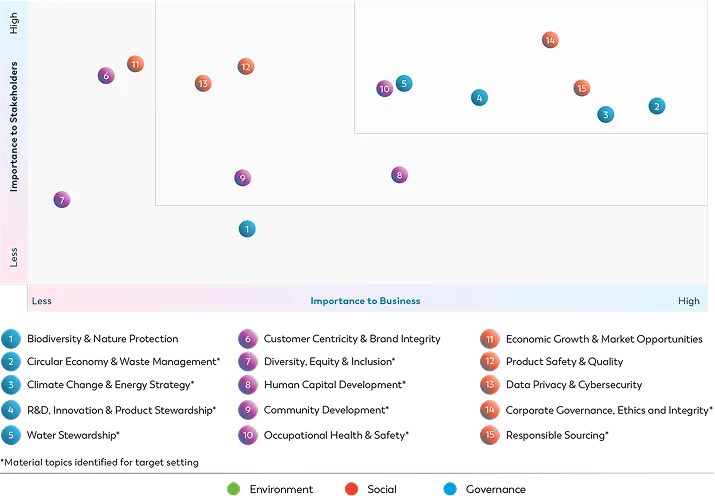

To maximise value creation, we conduct periodic evaluations that help us to assess internal requirements as well as risks pertaining to the external environment. The materiality assessment, therefore, enables us to prioritise material topics necessary for transforming Polycab into a more sustainable organisation.

Material Topics

Discover More

Discover More

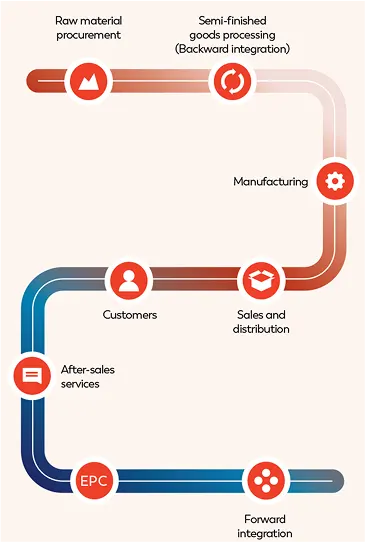

Our Value Chain

Creating shared value for our stakeholders

Investors

832%*

Share Price Growth Since Listing

Customers

₹2,24,083 Mn

Revenue from Customers

Employees

₹7,367 Mn

Employee Compensation

Value chain partners

₹1,68,300 Mn

Payments to Suppliers

Communities

₹356 Mn

Community Investments

Environment

₹202 Mn

Environmental Investments

Government and Regulatory Bodies

₹6,331 Mn

Payment to Government

*As of 19th May 2025

YoY increase

YoY increase Discover More

Discover More

Polycab employs a structured risk management framework that enables swift response to disruptions and informed decision-making.

Our Goals and Targets for Governance

Corporate Governance, Ethics and Integrity

15%

Women’s representation in senior

leadership roles by 2030

Discover More

Discover More