Market Pulse and Opportunities Landscape

The Wires & Cables (W&C) industry is witnessing strong growth, both in India and globally, driven by rising investments in power, infrastructure, clean energy, electrification and digital connectivity. Simultaneously, the Fast-Moving Electrical Goods (FMEG) sector is benefiting from India’s consumption boom, rising incomes and urbanisation. Polycab is well-positioned to seize existing and emerging opportunities and create sustained value for all stakeholders.

Sustained Growth in W&C Industry

Trends and Drivers

Robust Domestic Demand

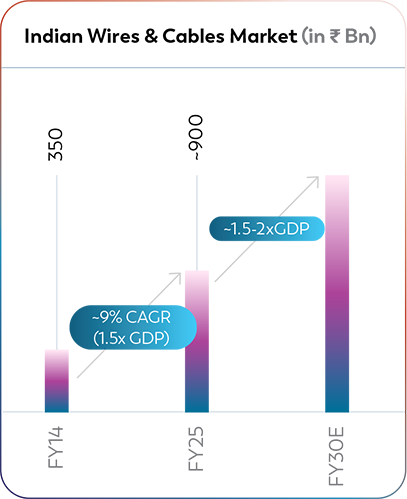

India’s W&C industry is poised for strong growth, driven by rising infrastructure investments, growing consumption, robust real estate growth and a manufacturing-led capex cycle. Government focus on power, transport and urban development, combined with private investments, is accelerating demand across sectors.

Emerging segments such as data centres, EVs and defence are further expanding the opportunity landscape. The industry is expected to grow at 1.5x to 2x of real GDP in the near to mid-term, with strong tailwinds favouring the higher range.

Expanding Export Opportunities

India is increasingly recognised as a competitive export base in the global W&C industry, driven by the China+1 strategy and rising global investments in renewables, data centres and infrastructure modernisation. Demand for high-quality, compliant and sustainable cables is growing across regions such as North America, Europe, the Middle East and Asia-Pacific. Developed economies are upgrading legacy grids, while emerging markets are building new infrastructure. The global shift towards clean energy is further boosting demand in the solar, wind, oil and gas and green hydrogen sectors.

Meanwhile, evolving regulatory expectations around fire safety, cybersecurity and environmental compliance are shaping global procurement practices. Many countries are introducing localisation norms and leveraging free trade agreements to encourage domestic participation, opening up opportunities for Indian manufacturers. These shifts are creating demand for speciality and certified cables, enabling Indian exporters to meet diverse global requirements with custom-built, regulation-ready solutions.

Dominance of Organised Players

The focus on safety, GST regulations and the complexity of W&C applications continues to shift market weightage towards organised players with the right expertise. The shift towards higher-voltage products is also expected to benefit larger players in the industry, helping them increase their market share.

How we meet them

Polycab is well-positioned to meet the growing demand, with a planned capex investment of `60-80 billion over the next five years, primarily in the W&C segment, to focus on:

- Expanding domestic W&C business at ~1.5x the industry growth rate

- Increasing the share of international business to over 10% of total revenue

Power Sector Investments

Trends and Drivers

Surging Power Demand

India’s per capita power consumption is set to rise from 1,395 in FY 2023-24 to 2,984 units by FY 2039-40E, moving closer to the current global average of 3,700+ units.

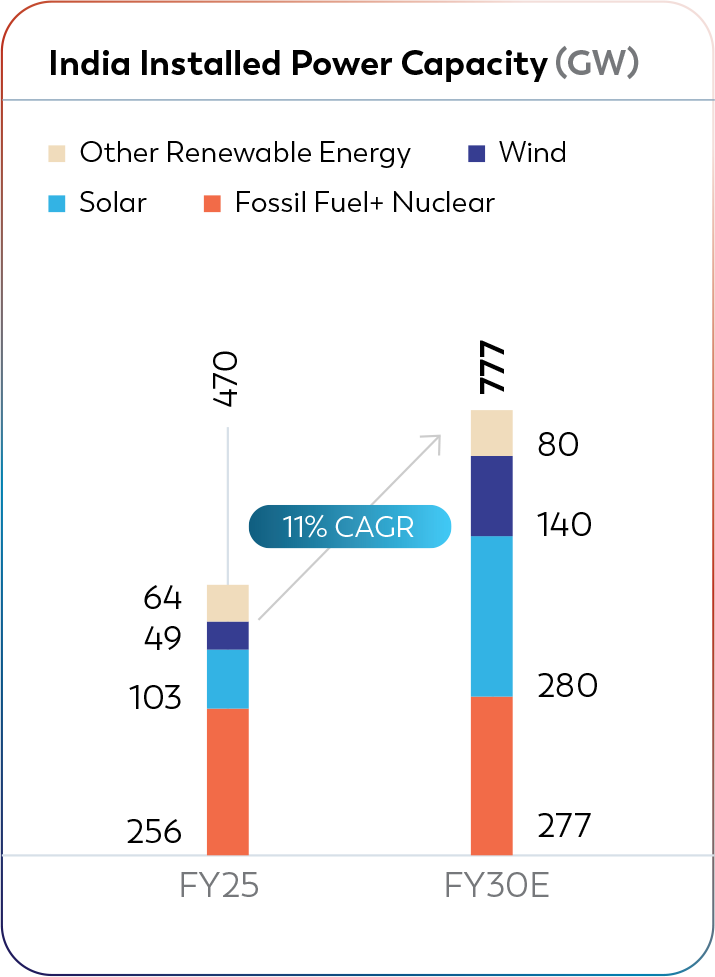

Accelerated Renewable Energy Expansion

India’s renewable energy capacity is estimated to grow from 216 GW to ~500 GW by FY 2029-30E, in keeping with its ambition of meeting 50% of its cumulative power capacity from non-fossil fuel sources by 2030. This transition will be supported by the Green Energy Corridor Scheme, ensuring efficient power evacuation into the grid.

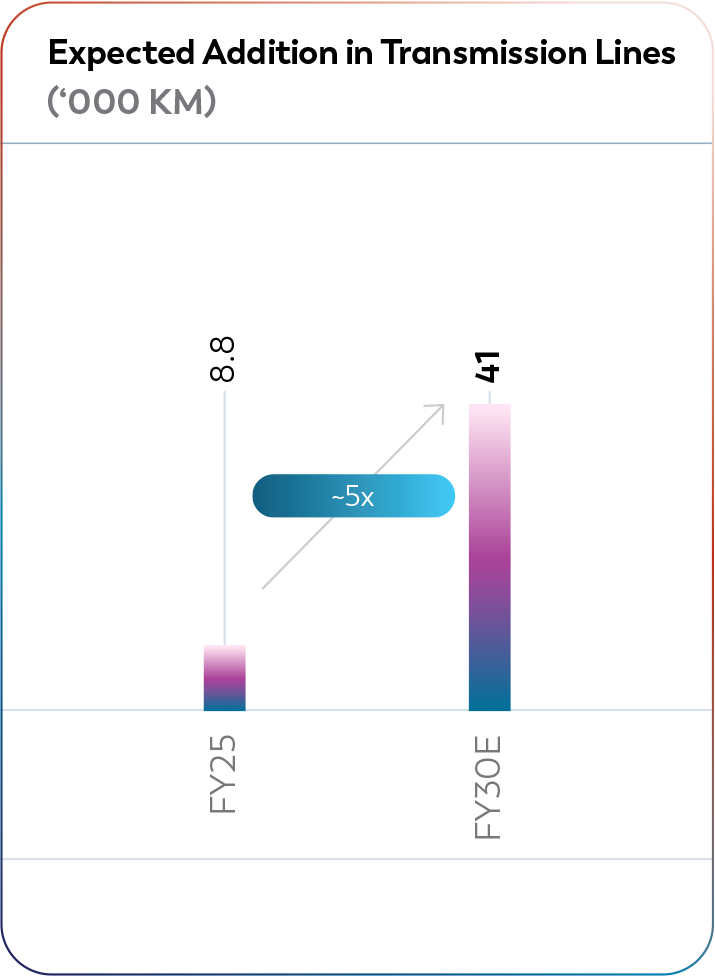

Strengthening Power Infrastructure

As the demand for efficient power transmission increases, India will be aiming for inter-regional grid projects to ensure power transfer from surplus to deficit states, especially from RE power plants concentrated in the West and South of India. The conversion of overhead power lines to underground cabling will continue, ensuring easier network expansion and greater weather resilience. So will the renovation and modernisation of grid and sub-transmission networks to support the shift towards higher capacity and improved efficiency.

How we meet them

- Investment of `6-7 billion for the development of EHV cables used in power transmission

- Supplying solutions for solar projects in the form of cables, inverters, panels and switchgears

- Increasing participation in EPC projects to enhance power distribution; our EPC open order book from the government’s RDSS scheme are valued at ~`40 billion

Government Push for Manufacturing

Trends and Drivers

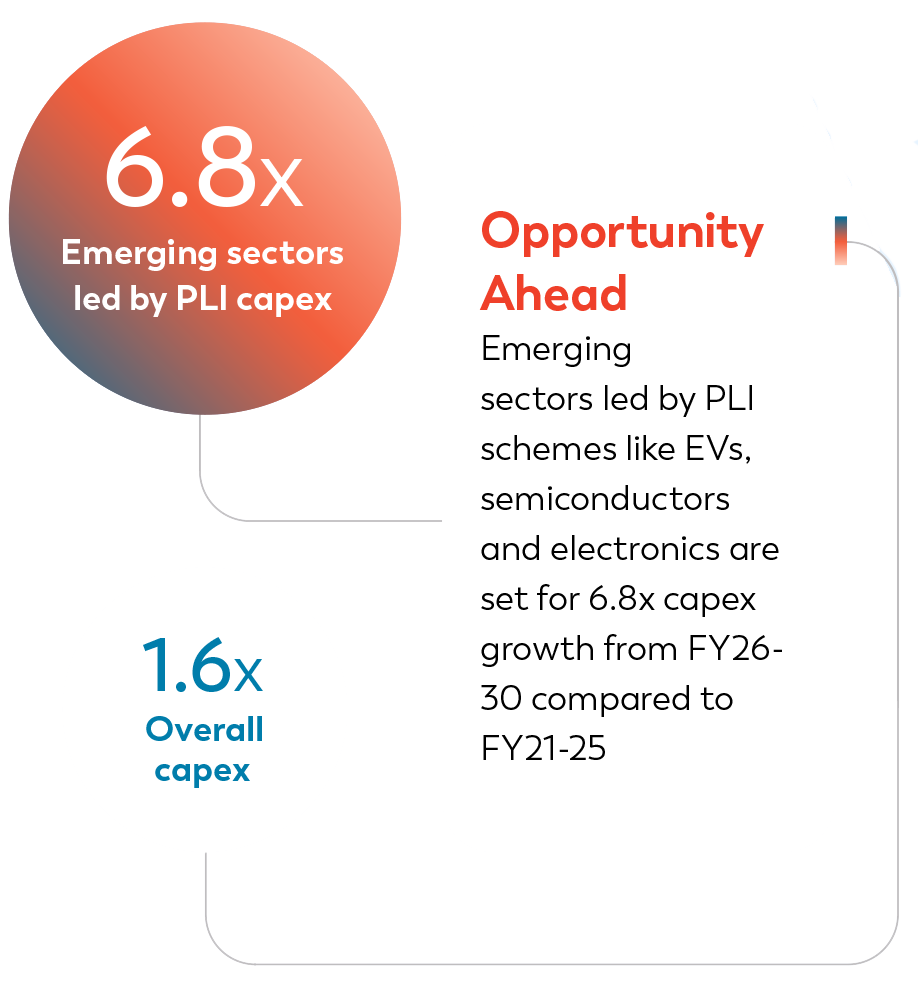

PLI-driven Industrial Expansion

The PLI scheme has catalysed `1.47 lakh crore in private capex, driving a 1.2% GDP boost and positioning India as a future-ready manufacturing hub. With emerging sectors like EVs, semiconductors and electronics poised for a 6.8x capex surge by FY 2029-30, the initiative underscores strategic alignment with global sustainability and tech trends, while 720 companies are projected to unlock $459 billion in incremental revenue over 5–6 years, accelerating self-reliance and job creation.

Surging Demand for Optical Fibre Cables

The expanding telecom, data centre, medical, defence and data storage sectors are driving the demand for optical fibre cable deployment. Anti-dumping duties on imports have led to a surge for domestic products. Indian telcos plan to invest $1.5-$2.5 billion in 5G rollout and the government in the midst of Phase - 3 of the BharatNet project, valued at `1.39 trillion, to provide broadband connectivity in rural areas.

Rapid growth in Refinery and Petrochemicals Sector

India’s refining capacity is poised for significant expansion, with plans to increase from 5,282 thousand barrels per day (b/d) in March 2025 to 5,935 thousand b/d by the end of 2027. This growth trajectory is driven by a wave of greenfield and brownfield projects, which are expected to add 652 thousand b/d of new refining capacity.

Manufacturing Sector Driving Private Investments

The average capacity utilisation in the manufacturing sector stands at ~75%, supporting private capital expenditure and driving growth. In the fiscal year 2025, private investments reached a significant milestone, with ~`38 trillion invested, with the chemicals, machinery and metals sectors leading the charge.

How we meet them

- Transitioning to a vertical-focused structure to capture sector specific opportunities

- Enhancing our capabilities to supply comprehensive electrical solutions to customers

- Expanded optical fibre cable capacity to meet rising demand, participating in BharatNet to enhance digital connectivity

- Focusing on premiumisation and energyefficient solutions to align with evolving consumer preferences

PLI Scheme: Key Achievements

`141 Bn

Disbursement by Government

`1.47 Tn

CAPEX by Pvt. Co.

1.2%

Incremental value addition as a % of GDP

More than 720 companies have the potential to generate an additional revenue of US$459 billion within a span of 5 to 6 years

Surging Real Estate Growth

Trends and Drivers

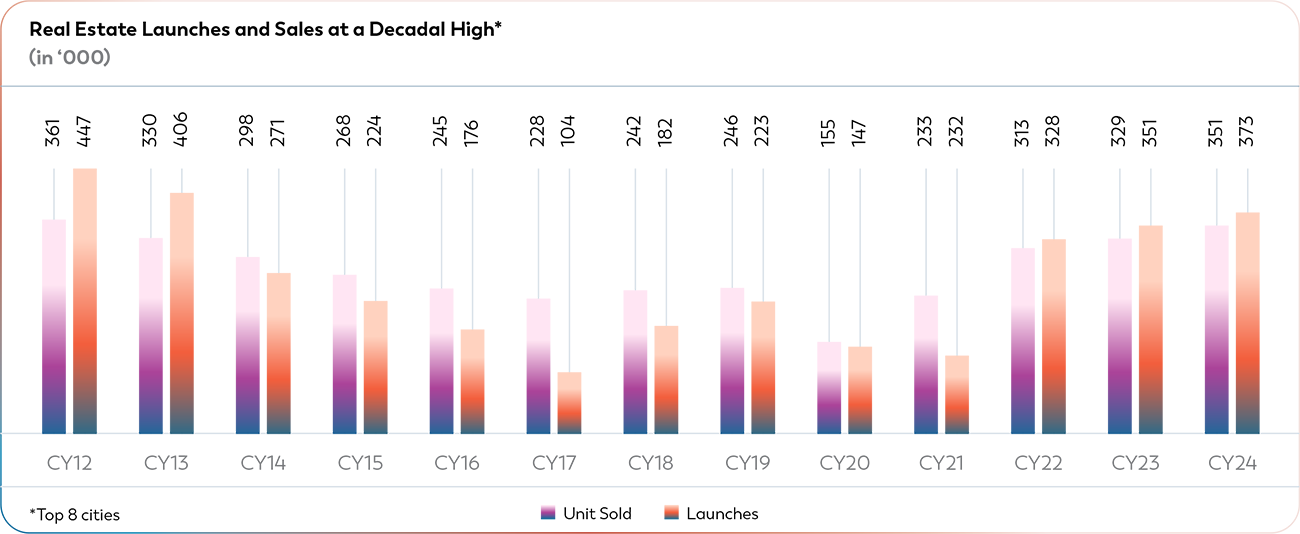

Residential Real Estate on an Upcycle

A multi-year growth phase is driving higher residential real estate volumes in the medium-term. Leading W&C players stand to benefit as top-tier developers prioritise suppliers with proven execution capabilities.

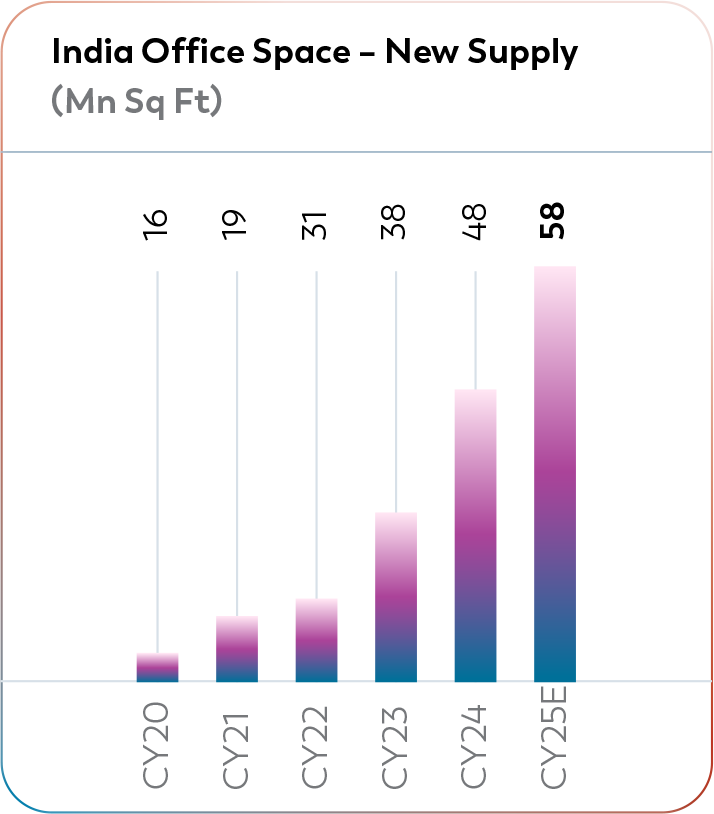

Commercial Real Estate Expansion

The rise of Global Capability Centres (GCCs) and infrastructure development in Tier II/III cities are accelerating demand. According to Mordor Intelligence, India’s commercial real estate market is projected to grow from an estimated $49.3 billion in 2025 to $128.4 billion by 2030, registering a robust CAGR of 21.1% during the forecast period.

Rapid Growth in Warehousing Infrastructure

India’s warehousing stock has tripled since 2016, reaching 354 million sq. ft . and is projected to expand to ~540 million sq. ft. by 2026. This surge is driven by growth in manufacturing and e-commerce.

Private Equity Investments on the Rise

As India’s economy expands, private equity investments in real estate are projected to reach ~$15 billion by 2034, growing at a CAGR of 15% from 2023.

How we meet them

- A real estate-focused vertical is being created to provide complete solutions

- Price laddering in wires to meet diverse customer demands

- Expansion of distribution network and increased influencer engagement to capitalise on growing demand

Public Capex Boom and High-Growth Sunrise Sectors

Trends and Drivers

Major Road Infrastructure Expansion

The national highway network is set to grow from 1.46 lakh km to 2 lakh km by 2037. Since FY 2017-18, over 10,000 km of highways have been added annually, enhancing connectivity and logistics efficiency.

Railway Expansion and Modernisation

In FY 2025–26, capital expenditure is estimated at `2.65 trillion, in the railways with 95% of it — `2.52 trillion — being funded by the Central government (vs ~1% in FY 2007-08). Over the next decade, `7 trillion+ will be invested to add 50,000 km of new tracks and to upgrade existing railways infrastructure.

Widening Metro Rail Network

Approximately, 1,000 km of Metro Rail lines are currently under construction, with an additional 1,000 km planned, enhancing urban mobility across key cities.

Expanding Airport Accessibility

Under the Gati Shakti initiative, 200 new airports, heliports and water aerodromes are planned. The AAI is expected to develop 50 new airports in Tier II & III cities over the next five years to improve regional connectivity.

AI and Policy Support To Drive Data Centre Growth

India’s data centre capacity is set to grow from ~900 MW to over 10 GW by FY 2029-30, with Mumbai, Chennai, Noida, Hyderabad and Bengaluru emerging as key hubs for expansion.

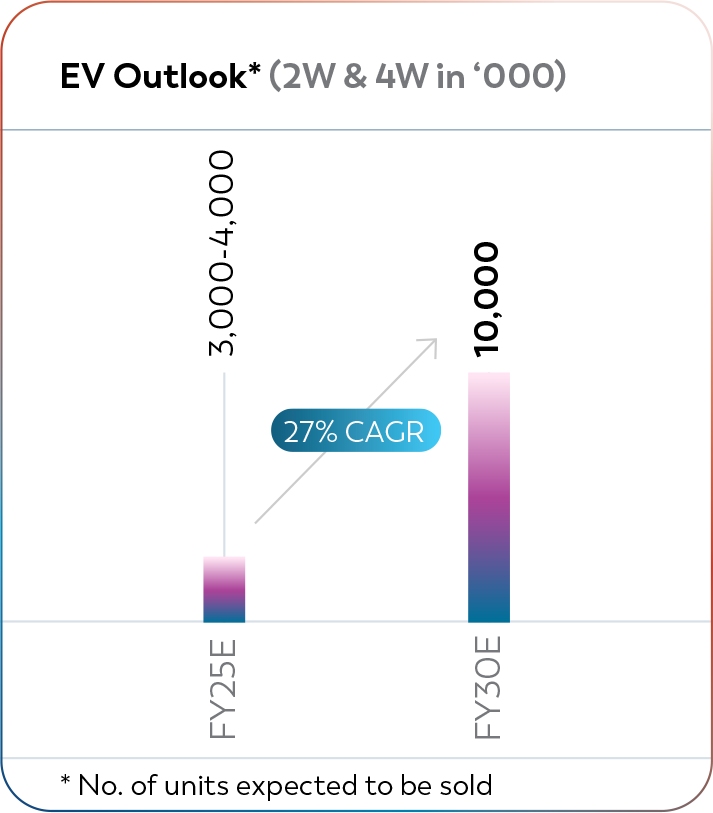

Accelerating EV Adoption

The Government of India aims for 30% electrification of private cars and 70–80% EV adoption in commercial vehicles, twowheelers and three-wheelers by 2030. Over 2 million EV charging stations are expected to be in place by then, supporting this rapid transition.

How we meet them

- Our W&C segment is supporting the expansion of the EV charging infrastructure with the supply of necessary cables and charging guns

- Actively supplying cables for data centres

- Contributing to the development of the national highway network and expansion of the rail and airport infrastructure with specialised products

- Providing cabling solutions for the construction and expansion of Metro Rail

Global Growth: Infrastructure Megatrends Driving Surging Demand for Wires & Cables

Trends and Drivers

China+1 Strategy

As global companies diversify their manufacturing bases beyond China, India has emerged as a favoured alternative destination. This diversification is unlocking significant export potential for Indian cable manufacturers in key markets including North America, Europe and Southeast Asia, where demand for compliant, high-specification cables continues to rise.

Electrification Push

With global electricity consumption projected to double by 2050, governments worldwide are intensifying investments in energy transmission infrastructure. The European Union plans to allocate $633 billion toward electricity grid modernisation by 2030, while the United States Grid Resilience Investment Program (GRIP) is injecting $10.5 billion into grid upgrades, collectively driving substantial demand for high-voltage and speciality cables.

Clean Energy Investments

The accelerating shift to renewable energy sources is fuelling extensive cabling requirements across solar, wind and hydrogen sectors. The EU’s commitment of $1.6 trillion to clean energy and grid projects underscores the scale of opportunity, with offshore wind capacity anticipated to surge from 12 GW in 2024 to 300 GW by 2050.

Digital Infrastructure and Data Centres

The rapid adoption of artificial intelligence and cloud computing is catalysing exponential growth in data centres globally. Investments in this space are projected to reach $49 billion by 2030, driving continuous demand for fibre optic cables, structured cabling systems and high-speed data transmission solutions.

EV and Charging Infrastructure Expansion

The electric and hybrid vehicle market is expected to comprise 55% of global vehicle sales by 2030. Correspondingly, public EV charging stations are forecasted to expand from 4 million in 2023 to approximately 15 million by 2030, intensifying the need for robust, safe and efficient EV cabling infrastructure.

Smart Cities and Urbanisation

Urban populations are set to reach 68% of the global total by 2050, accelerating demand for smart city infrastructure. Initiatives such as Saudi Arabia’s $1 trillion Vision 2030 and a projected $1.1 trillion global smart cities market by 2028 are driving large-scale requirements for low-voltage, fire-retardant and control cables essential for modern buildings and infrastructure.

How we meet them

- We are expanding our export business across these regions by leveraging our certified products, manufacturing excellence and adherence to global standards, which positions us as a trusted partner.

- We offer high-voltage and mediumvoltage cables, ensuring that we can meet the demand for modernising and expanding global energy transmission networks.

- We are expanding our solar-compatible cables, which are already being deployed in renewable energy projects globally

- We are providing advanced fibre optic and high-speed data cables, meeting the demand for reliable and scalable digital infrastructure

- We are providing low-voltage, fire-retardant cables for smart buildings, integrated transport systems and energy-efficient urban infrastructure.

FMEG Growth: India’s Consumption Surge to Power FMEG Product Penetration

Trends and Drivers

India to Become 3rd Largest Economy by FY 2027-28

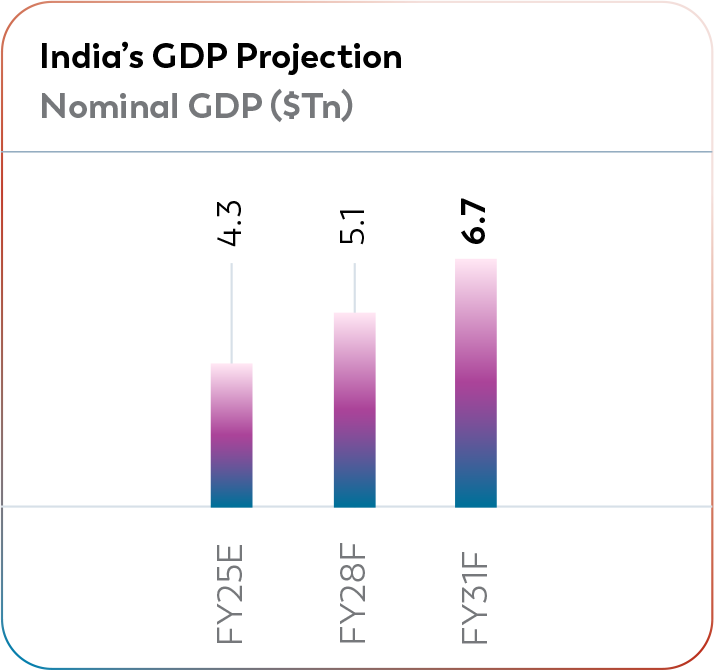

India’s economy is projected to ascend to the third largest globally by FY 2027-28, with nominal GDP estimated to grow from $4.3 trillion in FY25 to $6.7 trillion by FY31. This economic expansion is fuelling broad-based consumer demand, particularly across housing, electrification and lifestyle-related sectors.

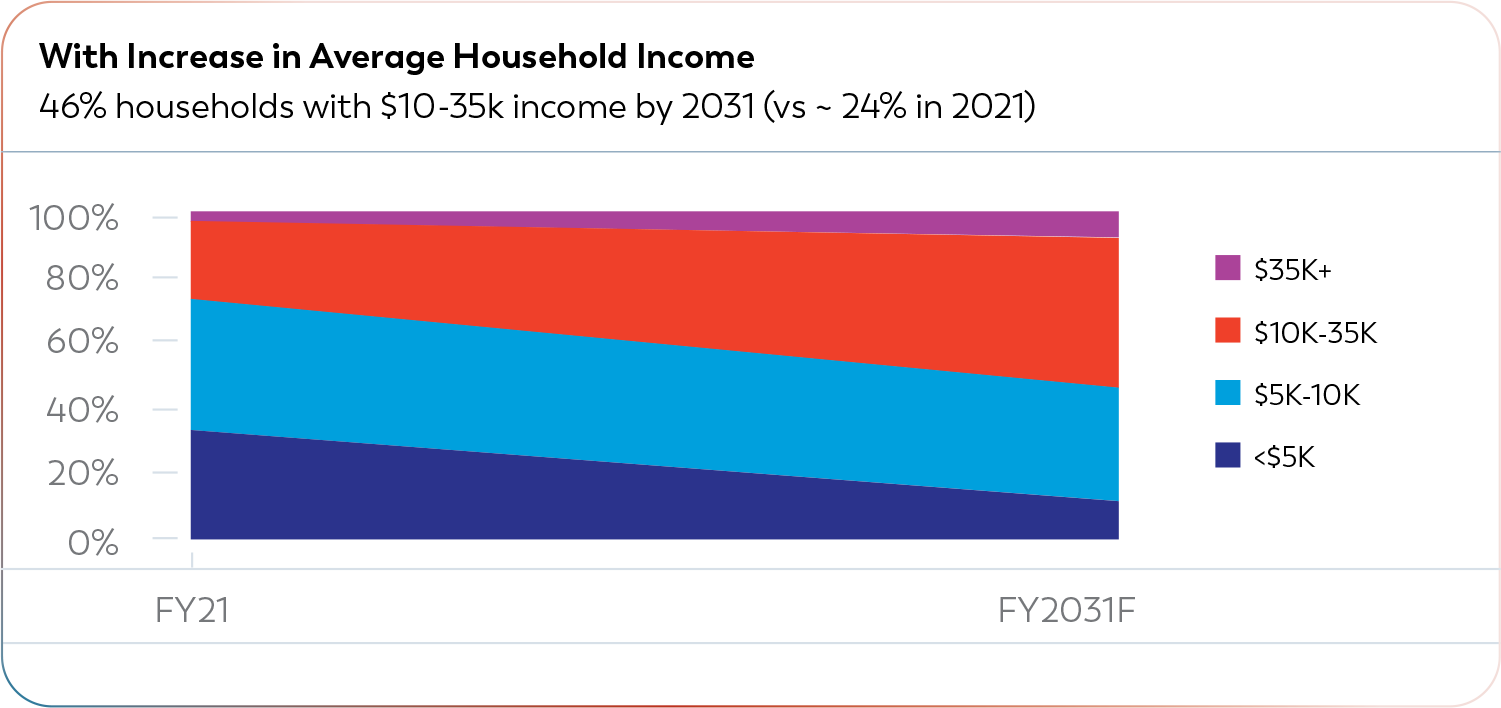

Rising Disposable Incomes

The share of Indian households with annual incomes between $10,000 and $35,000 is expected to nearly double from approximately 24% in 2021 to 46% by 2031. This significant income growth is anticipated to accelerate the adoption of premium, smart FMEG products across urban and semi-urban markets.

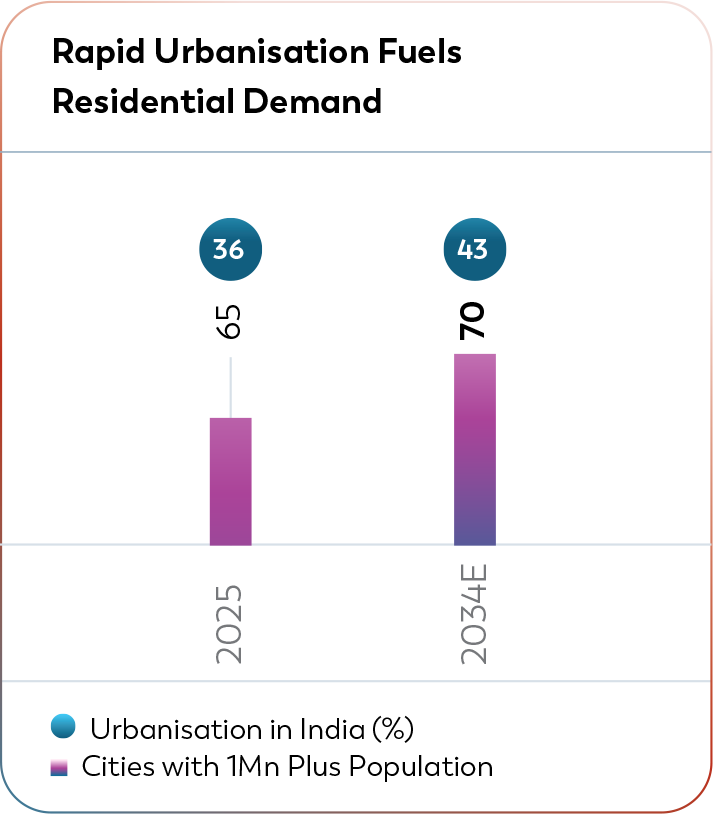

Rising Urbanisation

India’s urban population is projected to increase from about 36% in 2025 to 43% by 2034. Simultaneously, nuclear households are expected to rise from 295 million in 2021 to 360 million by 2031. These demographic shifts are driving demand for aesthetically designed energy-efficient electrical products tailored to modern residential needs.

Enhanced Access to Credit

The number of credit cards in circulation has doubled from 55.5 million in 2019 to approximately 110 million, with credit card spending reaching C 1.84 trillion in January 2025. Improved financial inclusion is enabling greater discretionary spending and increased consumption of premium electrical products.

Rising Workforce Participation

India’s Worker Population Ratio (WPR) has increased markedly, from 35.3% in FY 2018-19 to 58.2% in FY 2023-24, largely driven by growing participation from rural women. The rise in dual-income households is further catalysing demand within the electrical sector.

How we meet them

- We are aligning our product portfolio to cater to the growing demand for energyefficient and premium electrical solutions, which are key drivers of consumption in India’s expanding economy.

- We are focused on offering a wide range of premium electrical goods, including smart home solutions, energy-efficient lighting and premium fans, designed to meet the growing purchasing power of the urban and semi-urban population

- We continue to offer aesthetically designed, energy-efficient products like modular switches and designer fans, tailored to meet the needs of urban families.

- We are developing products across various price points to meet the diverse needs of our customers, ensuring that our offerings deliver exceptional value and cater to a wide range of preferences and budgets.