For nearly three decades, Polycab India Limited has been a name synonymous with excellence and innovation in the electrical solutions sector. As we turn the page to a bold new era, we are driven by a clear vision to transform ourselves and the conviction to consistently outperform expectations.

The development of robust R&D and manufacturing capacities over the years has equipped us to meet the demands of an expanding and ascending India. This positions us to consistently exceed expectations while serving our nation's needs.

We have redefined our purpose to align with our ambitions. This, along with our core values, guide our strategies and strengthen our capacity to create value for our stakeholders.

We are committed in our resolution to ensure that we remain agile and future-ready, poised to deliver innovative solutions that meet tomorrow’s needs today.

"Our journey this year has truly embodied the essence of ‘Vision to Transform, Conviction to Outperform’, as we've not only met but surpassed expectations, reaffirming Polycab’s status as a leader in the electrical industry"

Chairman & Managing Director

Polycab plans to maintain capex levels between `10-11 billion annually over the next three years, enabling it to not only meet current demand but also positioning the Company for sustained growth and market leadership in the future

Executive Director and CFO

Polycab is India's largest integrated manufacturer of Wires and Cables and a prominent player in the Fast-Moving Electrical Goods industry

W&C Revenue

SKUs

FMEG Revenue

SKUs

EPC Revenue

Value Creation at POLYCAB

Equity

Net cash

Manufacturing

units

Warehouses

and depots

Capex

Gross block of

fixed assets

Total R&D expenditure

Total registered IPR

People employed

on-roll

People employed

on contract

Total training

hours

CSR expenditure

Dealers and distributors

Retail outlets

Total energy consumption

Total water consumption

Revenue

(28% YoY)

EBITDA

(35% YoY)

RoCE

PAT

(41% YoY)

Proposed

Dividend

Sales from C&W products manufactured in-house

Capacity utilisation of installed capacity

IPR registered in FY 2023-24

IPR applied in FY 2023-24

Employees associated for 5+ years

Engagement Score in Survey

LTIFR

Lives impacted

Customer satisfaction

Material sourced from MSME vendors

Emissions avoided due to renewable energy

Water recycled

At Polycab, we prioritise sustainable practices that focus on environmental, social, and governance principles, putting consistent effort in areas ranging from climate change and energy to data security and privacy.

Understanding stakeholder

needs and material ESG risks

Developing roadmap

and ownership

Measuring impact and

improving

Establishing ESG

governance

Refining operations and

processes

Verification through internal

audits and external assurance

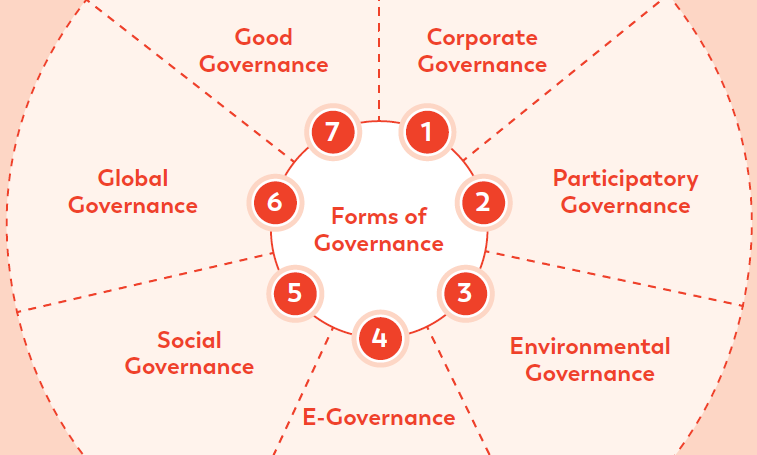

As the Company continues to achieve its strategic objectives; effective governance serves as the compass that guides the Company toward ethical conduct, effective growth and sustainable success. Besides control, the governance strategy at Polycab focuses on compliance, reliability, transparency, and accountability. The Company recognises ‘Governance’ as a continual process.

Internal and external risks are inevitable in a dynamic operating environment. To navigate this and stay ahead of the industry, we employ a comprehensive risk management process that allows us to adapt swiftly to unforeseen circumstances and seize the right opportunities. Through continuous monitoring and timely adjustments, we safeguard our operations, assets, and stakeholders’ interests.